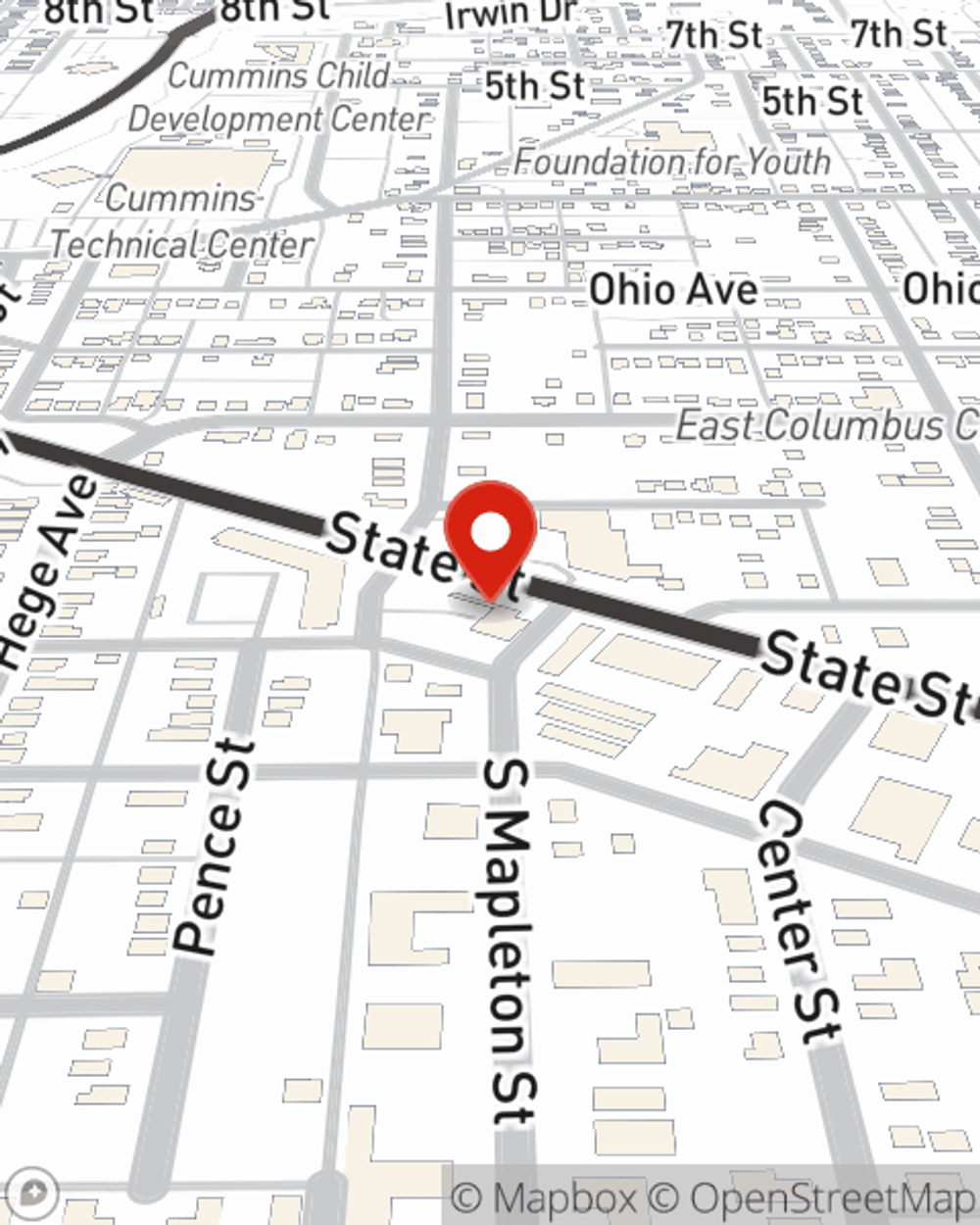

Business Insurance in and around Columbus

Calling all small business owners of Columbus!

Helping insure businesses can be the neighborly thing to do

- Columbus

- Seymour

- Brownstown

- North Vernon

- Edinburgh

- Hope

- Brown County

- Jackson County

- Jennings County

- Bartholomew County

- Scipio

- Hayden

- Elizabethtown

- Taylorsville

- Franklin

- Crothersville

- Freetown

- Westport

- Commisky

- Butlerville

- Jonesville

- Nashville

- Nineveh

- Trafalger

Help Protect Your Business With State Farm.

Preparation is key for when the unexpected happens on your business's property like a customer slipping and falling.

Calling all small business owners of Columbus!

Helping insure businesses can be the neighborly thing to do

Cover Your Business Assets

With options like a surety or fidelity bond, extra liability, worker's compensation for your employees, and more, having quality insurance can help you and your small business be prepared. State Farm agent Alisha Roberts is here to help you personalize your policy and can assist you in submitting a claim when the unexpected does happen.

Do what's right for your business, your employees, and your customers by contacting State Farm agent Alisha Roberts today to explore your business insurance options!

Simple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Alisha Roberts

State Farm® Insurance AgentSimple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.